Companies with global business operations and customers are continually affected by changes in the exchange rate. As a SaaS company, when you sell products or services to your customers abroad in a foreign currency, any fluctuations in exchange rates will impact the payment you receive in your functional (home) currency. This fluctuation results in foreign currency gain or loss for your business.

This article explains the accounting concepts of foreign exchange (FX) gains and losses for financial reporting and their importance for SaaS businesses, along with the challenges and best practices involved in calculating FX gains and losses.

Accounting for foreign exchange (FX) involves recording transactions conducted in currencies other than a company’s functional currency and adjusting them for changes in exchange rates. You can think of a company’s functional currency as its “home currency” – the currency of the primary economic environment in which it operates (where the company is registered and has its headquarters).

FX accounting includes the translation of foreign entity financial statements into the parent company’s functional currency during consolidation.

A global customer base can make SaaS businesses more vulnerable to FX risks and currency fluctuations, potentially impacting their revenue and profitability. This impact can become more pronounced at scale, as SaaS businesses expand (i.e., establish subsidiaries) and/or diversify their products and services across geographies.

In this article, you’ll learn how FX gains and losses affect financial statements, the importance of these accounting principles for your SaaS business, and how to calculate and report FX gains/losses in your consolidated financial statements.

What are foreign exchange rate (FX) gains and losses?

An FX gain or loss happens when there is a change in the FX rate after an invoice is issued and before it is paid.

For example, when your company invoices a customer abroad, it might be in a different currency than the company’s functional currency. While you would have converted your prices correctly based on the exchange rate at the time you raised your invoice, when the customer actually pays the invoice, the exchange rate might be different from what you used for the invoice in your accounting system. If it is, the payment you receive won’t match the amount on the original invoice.

When an invoice is entered in at one rate and paid at another, this generates an exchange gain or loss—relative to the amount invoiced. If the currencies involved have increased or decreased in value, that change will result in either a gain or a loss.

If you’re a business with international customers or vendors, you are continually affected by changes in the exchange rate. This is because you may receive foreign currency payments from customers outside your home country and/or send payments to vendors in a foreign currency. Any FX gains and losses arising from these transactions must be recorded in your financial statements.

All companies, when preparing the annual financial statements, must report all transactions in their functional currency to ensure that all stakeholders, including investors, creditors, and company leaders, can accurately understand the financial reports.

Therefore, any and all transactions carried out in foreign currencies must be converted to the functional currency using the exchange rate at the time the transaction was entered into the accounting system.

Why accounting for FX gains/losses is especially important for SaaS businesses

Accurate reporting and accounting for FX gains and losses enables SaaS companies to:

- Correctly assess the impact of fluctuating currency exchange rates on their financial statements.

- Determine the exact differences between fluctuations based on significant economic factors vs. normal daily exchange rate fluctuations.

- Scale their business operations and services in different geographies by transacting more efficiently with vendors and customers in different currencies.

- Continue to remain GAAP compliant (if your business is headquartered in the US) when expanding globally.

As a SaaS business owner with international customers, vendors, even foreign subsidiaries, you are continually affected by changes in the exchange rate, since you may receive foreign currency payments from customers outside your home country, send payments to vendors in a foreign currency, and reconcile the financials of your subsidiaries—each with its own chart of accounts. That’s a lot of work for finance teams in terms of financial reporting!

So, while global expansion and diversification of services/products seems like the natural next step for SaaS businesses, it does also present new and interesting challenges, especially for finance teams vis-a-vis FX gains and losses.

Reporting foreign exchange transactions in your financial statements

All companies, when preparing the annual financial statements, have to report the transactions in their functional currency to ensure that all stakeholders, including investors, creditors, and company leaders, can accurately understand the financial reports.

Further, any and all transactions carried out in foreign currencies must be converted to the functional currency using the exchange rate at the time the transaction was entered into the accounting system.

FX gains and losses are reported on the income statement. as a separate line item or they may appear under the “Other Comprehensive Income (OCI)” category.

Here’s an example of how to report FX gains/losses on an income statement:

Standards that guide the reporting of FX gains and losses

The International Financial Reporting Standards (IFRS) International Accounting Standards (IAS) 21 outlines the principles associated with accounting for foreign currency transactions and operations in financial statements, as well as how to translate financial statements into whatever currency you use for reporting.

For specific rules regarding how FX gain and losses should be reported, you can refer to the Generally Accepted Accounting Principles (GAAP) Accounting Standards Codification (ASC) Topic 830.

Realized vs unrealized FX gains and losses

When an invoice is raised per the exchange rate on that day and paid in another—at the time of payment, the exchange rate could be different—-you could incur an exchange gain/loss, depending on how the exchange rate has impacted the currencies involved.

Realized FX gains and losses

A foreign currency gain or loss is “realized” when the customer has paid the invoice before the close of the accounting period. This occurs on transactions that have been “settled” (paid) during the current accounting period. Realized FX gains/losses are recorded in the income statement.

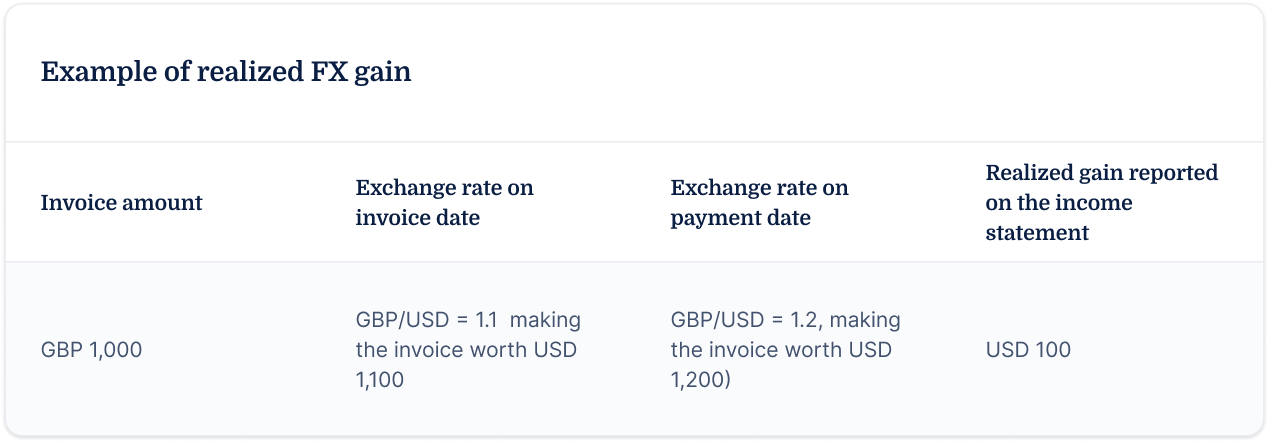

For example, your home currency is USD and you have raised an invoice worth GBP 1,000. On the date you raised the invoice, the 1,000 GBP was worth USD 1,100. On the date the customer pays the invoice, the value of the GBP is now USD 1,200. So, now you have made a “realized” gain of USD 100.

Unrealized FX gains and losses

A foreign currency gain or loss is “unrealized” when the customer has not paid the invoice before the close of the current accounting period.

It’s important to note that unrealized FX gains and losses are reported by a company during the consolidation of financial statements, when it converts outstanding receivables or payables into a different currency per the date mentioned on the balance sheet.

Since the outstanding amount has not yet been received by the Accounts team, the resulting FX gains and losses is not “realized”. Therefore, it does not feature on the income statement. Instead, unrealized FX gains or losses are recorded in the balance sheet (under the owner’s equity section).

Let’s look at the following example. Your home currency is USD and you have raised an invoice worth GBP 1,000. On the date you raised the invoice, the 1,000 GBP was worth USD 1,100. Now, the customer has not paid the invoice by the end of the accounting period. On the last day of the accounting period, the value of the GBP dropped to USD 900. So, now you have an unrealized loss of USD 200.

To sum up, realized FX gains and losses accrue after completion of a transaction, when the currency is converted. Conversely, unrealized gains/losses are a result of revaluation of foreign currency-denominated balances at the reporting date.

Best practices for for calculating FX gain and losses

- Identify the relevant exchange rates: Determine the applicable exchange rates in effect at the time of undertaking a transaction and the reporting date. Reliable sources for accurate historical exchange rates include central banks of respective jurisdictions and foreign exchange ministries.

- Differentiate between stages of FX gains and losses reporting: While preparing consolidated accounts, differentiating between realized and unrealized gains and losses is crucial. Realized FX gains and losses accrue after completion of a transaction, when the currency is converted. Unrealized gains and losses, on the other hand, are a result of revaluation of foreign currency-denominated balances at the reporting date.

- Apply consistent methodology: Being consistent over different periods in calculating FX gains and losses, e.g., using the same exchange rate source and type, like spot rate, average rate a period, etc., across all transactions, helps in correctly recording foreign currency transactions and preparing accurate financial reports for all stakeholders.

- Document and track transactions: Maintaining detailed records of foreign currency transactions, including dates, amounts, and exchange rates (especially fluctuations), help in accurately calculating and verifying gains and losses.

- Use functional currency: Calculating gains and losses in the company’s functional currency helps maintain consistency in financial reporting and compliance with accounting standards.

- Understand tax implications: Tax treatment of FX gains and losses differ from one jurisdiction to another. Accurate tracking of foreign exchange gains and losses is critical to ensuring compliance with tax code and making correct tax payments.

Challenges in calculating FX gains and losses

The best practices described above will help you meet a lot of the challenges associated with calculating FX gains and losses. However, it's good to know what those challenges will be so you can meet them head-on.

Exchange rate volatility

Operating in multiple jurisdictions can get complicated if exchange rates are volatile. Frequent fluctuations in exchange rates can lead to uncertain returns from business operations due to FX gains and losses.

Data accuracy and management

Businesses need to track and report accurate historical exchange rates and current exchange rates for equity translation and calculation of FX gains and losses. To do so entails robust data management systems.

Complexity in consolidation

For SaaS companies with foreign subsidiaries, consolidation of accounts into one currency adds to the reporting complexities.

Most SaaS companies lack multi-entity reporting systems and instead rely on separate general ledgers for each of their group entities. This is a major pain point because while consolidating their accounts, companies must export their data into spreadsheets and collate it all into an ad-hoc, manually prepared report.

Manual processes have a higher tendency to fail while scaling up. As you expand, you have to determine the exchange rates manually from the ad-hoc sources you have identified. As global transactions increase, the risk of non-compliance with GAAP standards also increases due to errors in manual data entry.

In this situation, financial reporting software helps eliminate any risk of non-compliance, allowing standardized, error-free consolidation of accounting reports.

How Drivetrain makes the whole process easier

Any business, SaaS or otherwise, needs to follow a few important accounting rules when carrying out operations and transactions in foreign currencies, primarily to calculate and record FX gains and losses in their dedicated accounts.

Many SaaS companies still rely on the traditional methods of consolidating financial statements, which not only require manual sourcing of data and the use of unwieldy spreadsheets, but also involve allocating precious time and human resources (that could be used for more strategic purposes) from an already stretched finance team.

Leveraging a financial planning and analysis (FP&A) software like Drivetrain can enable you to automate daily accounting tasks and equip your finance team to accurately record and report your management of your foreign exchange transactions.

Check out Drivetrain to see how easy it can be to consolidate all your financial data from different sources into a single source of truth for your entire business. With 200+ integrations, you can easily access more accurate data, reduce manual errors, and even slice and dice that data per your requirements to get more control over your numbers!

Frequently asked questions

Functional currency is the currency in which your main business operations are conducted, where most sales and expenses occur. It determines how foreign exchange gains and losses are reported. If a transaction happens in that currency, the gain or loss shows up in profit or loss. If you translate a foreign subsidiary using a different currency, the impact goes into equity through Other Comprehensive Income (OCI), instead of your P&L. Setting this correctly keeps your financial reporting accurate.

Realized FX gains or losses happen when a foreign currency transaction is settled, meaning cash is exchanged. That gets recorded in your income statement. Unrealized FX changes occur when you revalue outstanding balances, such as receivables or payables, at the end of a period. Those adjustments go into equity under other comprehensive income, not profit or loss.

If you fully sell a foreign subsidiary, you transfer all of its cumulative translation adjustment from equity into profit or loss. If you sell just a portion but keep control, the adjustment is allocated to non-controlling interests or remains in equity, in proportion to the remaining interest. This keeps your income statement clean and reflective of the transaction.

For recurring bills in different currencies, any FX movement on unpaid amounts is included in profit or loss. Translating an entire foreign subsidiary’s financial statements into your reporting currency creates a translation difference, which goes into equity. Separating these two keeps your profit reporting focused while accurately reflecting currency effects.

.svg)

.webp)

.svg)