Revenue planning translates pipeline data into actionable insights that CFOs need to make data-driven decisions about what their sales targets should be and how to meet them faster.

The right revenue planning software can help you create more reliable sales forecasts by identifying key drivers and bottlenecks in your pipeline and evaluating the impacts of different strategies for optimizing revenue generation, costs, and profit. It can also help you become more agile in your decision-making, allowing you to keep your finger on the pulse of your pipeline and quickly reforecast opportunities when needed to meet your targets.

CFOs have a lot of options today when it comes to choosing revenue forecasting software for their business. If you’re trying to figure out what revenue forecasting solutions to consider, you’re in the right place.

We reviewed a total of 12 solutions for this updated software guide. To cover the broadest range of possible needs, we’ve broken these tools out into three categories based on the needs of the market sector they target with their solution:

- Enterprise, which is defined as 1000 employees and/or more than $100M ARR

- Mid-market businesses defined as 50-1000 employees, and/or $5-$100M ARR

- Small businesses, defined as 0-50 employees with greater than $5M ARR

We reviewed five each for the enterprise and mid-market categories and another three for small businesses and early-stage startups.

For this evaluation, we consulted a wide range of sources, including vendor websites and product documentation, independent software review platforms, customer testimonials and reviews, and third-party analyst reports.

For each solution, you’ll find a summary of the key features related to the revenue planning it offers and some of the pros and cons you might want to consider as you evaluate your options.

We’ve also included a new discussion about how AI is being incorporated into the CFO and finance functions today. For this, we highlight three platforms that are leading the way forward with AI in how they are incorporating it into their platforms to enhance their revenue planning and other functions. This information will benefit CFOs and others working in corporate FP&A who want to leverage the power of AI to streamline their work and improve financial performance.

The best revenue planning solutions for enterprises

Enterprise revenue planning solutions have transformed from basic forecasting tools into powerful financial command centers. These platforms now sit at the heart of financial operations for finance leaders, connecting previously siloed revenue streams and revealing the complete financial picture across sprawling organizational structures.

When evaluating options, look beyond flashy sales pitches to assess what truly matters: time to implementation, integration capabilities with your existing tech stack, and total cost of ownership (TCO). Multi-currency support and AI-enabled modeling shouldn't just exist as checkbox features but should genuinely enhance forecasting accuracy.

While collaborative features are also appealing, getting the most value from them requires fine-grained access controls. This promotes transparency while maintaining appropriate governance over sensitive financial data. The best solutions deliver all this without sacrificing ease of use, recognizing that revenue planning is complex enough without adding to that.

In this guide, we cover five revenue planning software solutions suitable for enterprise organizations: Drivetrain, Anaplan, SAP Integrated Business Planning, Workday Adaptive Planning, and Pigment.

Let’s take a look now at how these solutions stack up in terms of their enterprise-level revenue planning features. The table below offers a quick look at that, followed by a more detailed analysis of each solution.

| Software/ Platform |  |  |  |  |  |

|---|---|---|---|---|---|

| Price | $$ | $$$ | $$$ | $$-$$$ | $$$ |

| G2 ratings | 4.8 | 4.6 | 4.3 | 4.3 | 4.6 |

| Time to ROI | 6 months | 17 months | 12+ months | 22 months | 15 months |

| Time for implemen-tation | 4-6 weeks | 5-7 months | 8-10 months | 3-5 months | 3-6 months |

| Total cost of Ownership | Medium | High (requires consultants/ implementation partners) | High (requires consultants/ implementation partners) | High (requires consultants/ implementation partners) | High (requires consultants/ implementation partners) |

| No. of integrations supported | 800+ | 50-60 | 100+ | 60-100 | 20 |

| Multi-curreny support | |||||

| AI-enabled modeling | |||||

| Collaborations with fine-grained access control | |||||

| Ease of use |

Our top pick for enterprises is Drivetrain. Drivetrain has served the mid-market well and offers enterprise-level features that make it a worthy contender, one built on modern technologies that ensure the high performance that enterprises today require.

Drivetrain excels in areas that matter most to enterprise FP&A teams: AI-enabled modeling, driver-based forecasting, and intuitive collaboration features with fine-grained access controls. These capabilities are critical for companies managing complex, multi-entity operations and recurring revenue models.

What truly differentiates Drivetrain is its flexibility and customization that fit each organization's unique planning processes without requiring in-depth technical experience. With over 800 native integrations, the platform brings the idea of “single source of truth” to life. Unlike legacy revenue planning software, Drivetrain’s implementation timeline is incredibly short (4-6 weeks), and its in-house onboarding team ensures a reasonable TCO. Enterprises looking for a powerful yet simple revenue planning software will find Drivetrain a natural choice.

800+ integrations to automatically consolidate data from all the business systems that contain data for revenue planning

Customizable forecasting models with advanced AI capabilities to enhance accuracy

Best-in-class calculation engine with power to scale

Easy-to-use, self-service spreadsheet-inspired UI

Multi-scenario and what-if modeling

Heavily focused on B2B businesses

Predictive forecasting capabilities

Multi-dimensional modeling capabilities

Comprehensive scenario modeling with real-time updates

Advanced driver-based modeling with AI integration

What-if analysis and sensitivity analysis with built-in sensitivity testing tools

Rapidly expanding multi-entity capabilities

Anaplan is a financial planning and analysis tool that serves multiple enterprise planning functions, including revenue planning. Its key strength lies in its proprietary Hyperblock calculation engine, which enables complex modeling across large datasets.

However, Anaplan presents several notable challenges for enterprises. Implementation typically requires specialized consultants with Anaplan-specific certifications, leading to higher initial and ongoing costs. The platform's interface and model-building approach have a steeper learning curve compared to more modern alternatives, often requiring dedicated model builders rather than enabling business users to create their own models.

Additionally, customers frequently report that achieving meaningful integration with source systems requires substantial effort, additional licenses, and technical expertise. All of this significantly hikes up TCO and lowers time to value, making Anaplan an expensive choice compared to other revenue planning software.

Connected planning

Real-time collaboration features

Multi-dimensional analysis capabilities

Limited number of native integrations

Long implementation times (usually 6 months or more)

Steep learning curve

Complex pricing model

Comprehensive driver-based modeling

Scenario planning capabilities including multi-scenarios and what-if analysis

Basic predictive capabilities (requires configuration)

Robust multi-entity management

SAP Integrated Business Planning

SAP Integrated Business Planning combines planning, analysis, and predictive capabilities in a single platform, with particular appeal to organizations already invested in the SAP ecosystem. Its integration with SAP S/4HANA and other SAP applications provides streamlined data flows for companies using these systems as their primary business applications.

The platform offers solid visualization tools alongside its planning functionality. This allows users to create dashboards and reports from the same environment where planning occurs. As with the other enterprise solutions covered in this guide, SAP Integrated Business Planning provides multi-entity management features to accommodate complex organizational structures.

Despite these advantages, SAP Integrated Business Planning presents significant limitations for many revenue planning use cases. The platform often requires substantial configuration to adapt to specific business workflows. Organizations frequently cite challenges in building complex, driver-based models without extensive workarounds.

Users also report performance issues when working with large datasets or complex calculations, which can hamper productivity during critical planning cycles. Additionally, the platform's user experience tends to be less intuitive than more specialized planning solutions, increasing training requirements.

Combined planning and visualization capabilities in one platform

Embedded predictive analytics tools

Familiar environment for organizations already using SAP solutions

Complex configuration requirements for specific business workflows

Building effective driver-based models often requires workarounds

Performance issues with large datasets or complex calculations

Less intuitive user experience increases training requirements

Integrated business planning across finance and operations

Smart predict functionality for automated forecasting

Version management for tracking planning iterations

Workday Adaptive Planning is a corporate performance management tool that includes revenue planning features. It is designed for large enterprises that are seeking strong capabilities outside of revenue forecasting and FP&A, making it attractive to businesses looking to transform their financial processes company-wide.

Workday Adaptive Planning provides the multi-entity management features necessary to support the more complex organizational structures typical of enterprise operations. It also offers driver-based modeling capabilities and other types of modeling, along with scenario planning tools necessary for enterprise-level financial forecasting.

Flexibility to create your own planning models

Ability to create customized reports

No upgrades to new planning sheet types in the past few years

Creating separate sheets for all prepaid expenses is cumbersome

Exporting to Excel or PDF format is time-consuming and difficult

Offers only 7 pre-configured data connectors (adapters)

Longer implementation times with heavy dependence on third-party system integrators

Not ideal for teams wanting to experiment with revenue or expense structures

Annual planning

Sales capacity and headcount planning

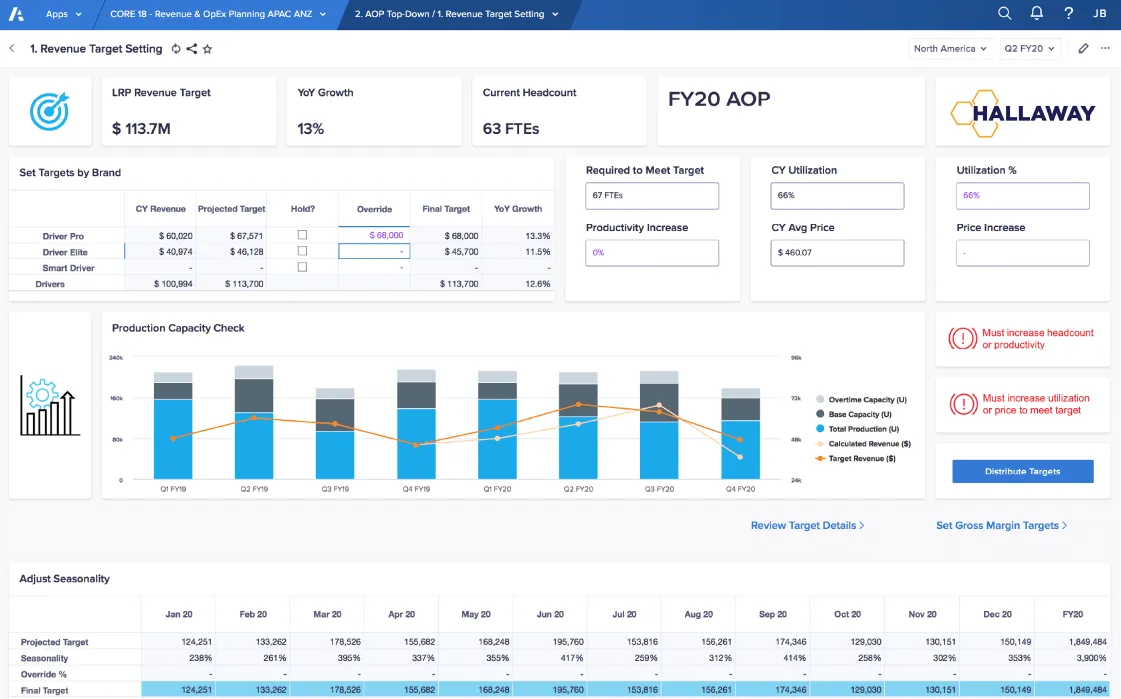

Top-down sales target setting

Collaborative financial modeling

Pigment is one of the newer entrants into the enterprise market but with a level of complexity comparable to more mature systems. Finance teams appreciate the relatively strong data modeling capabilities that support advanced business logic and the interactive dashboards that help communicate revenue planning outputs to stakeholders.

Pigment offers scenario planning capabilities, including strong what-if analysis to help enterprises make informed decisions. It also offers predictive forecasting capabilities, but they require manual validation of forecasting assumptions.

Despite these capabilities, the platform shows notable limitations in revenue planning contexts. In comparison to the other solutions we reviewed, Pigment’s range of integrations is much more limited, which may make it less suitable for large enterprises. Implementation demands significant configuration to adapt to specific business requirements, and experiences with the platform's performance vary considerably when handling complex models or large datasets.

Modern, intuitive user interface with strong visualization tools

Flexible but somewhat limited multi-dimensional modeling

Driver-based forecasting and rolling forecast capabilities

Good performance with large datasets

Limited number of native integrations

Data model setup and system configuration leads to longer implementation times

Complex implementations require dedicated project team involvement

May require more technical expertise for advanced modeling

Scenario planning and what-if analysis

Multi-currency support and basic consolidation features

Driver-based forecasting capabilities

The best revenue planning solutions for mid-market companies

Mid-market companies need tools for revenue planning that deliver advanced capabilities without breaking the bank or requiring a team of specialists to operate. You need software that hits the ground running, solutions with implementation measured in weeks, not months.

Look for multi-scenario modeling that lets you play out different business conditions without needing additional expertise. AI-powered forecasting should enhance your team's capabilities, not replace their judgment with algorithms. A few things to consider: Can the software connect seamlessly with your CRM and accounting systems? Does it support multiple currencies for when you're ready to expand globally? The winners in this category bring finance, sales, and operations together with intuitive interfaces and easy collaboration tools.

In this section, we cover five solutions with features that meet many of these and other needs of mid-market businesses. They are Drivetrain, Planful, Mosaic, Datarails, and Cube. The table below offers a quick comparison of their relative strengths and weaknesses in terms of revenue planning capabilities for mid-market businesses. Below the table, you’ll find a detailed description of each solution to help you better evaluate them for your unique business.

| Software/ Platform |  |  |  |  |  |

|---|---|---|---|---|---|

| Price | $$ | $$ | $$$ | $$ | $$ |

| G2 ratings | 4.8 | 4.3 | 4.7 | 4.6 | 4.5 |

| Time to ROI | 6 months | 17 months | 8 months | 18 months | 10 months |

| Time to Implemen-tation | 4-6 weeks | 3-6 months | 2-4 months | 2-4 months | 3-5 months |

| Total cost of ownership | |||||

| No. of integrations supported | 800+ | <10 | 30-45 | 200+ | 40-60 |

| Multi-dimensional modeling | Unlimited | Limited to 8 | Unlimited | Unlimited | Limited to 8 |

| AI-enabled modeling | |||||

| Multi-scenario modeling | |||||

| Collaboration with fine-grained access controls | |||||

| Ease of use |

Drivetrain stands out as the clear leader in mid-market revenue planning software. With onboarding timelines of 4-6 weeks, businesses start to realize ROI in under 6 months, creating an immediate impact on revenue forecasting accuracy and planning efficiency.

What truly sets Drivetrain apart is its powerful yet intuitive multi-scenario modeling capabilities, which enable finance teams to create unlimited scenarios with variable assumptions. This flexibility proves invaluable for revenue planning, where the ability to model different pricing strategies, growth trajectories, and market conditions directly impacts decision quality.

The platform also offers AI-assisted forecasting for more accurate projections. With 800+ native integrations, Drivetrain pulls revenue data from virtually every source: CRMs, ERPs, billing systems, and specialized sales tools. This eliminates data silos that typically plague revenue planning processes, ensuring that forecasts incorporate all relevant variables. Drivetrain's fine-grained access controls further enhance collaboration by enabling safe sharing of sensitive revenue data across departments, ensuring sales, marketing, finance, and operations all work from the same truth source.

AI-powered modeling

Customizable forecasting models

800+ integrations with ability to flexibly ingest data from any system

Easy-to-use, spreadsheet-inspired UI

Robust collaboration features, with granular access controls

Real-time automated reporting with predictive elements

Heavily focused on B2B businesses

Predictive forecasting capabilities

Dynamic, AI-powered scenario planning and what-if analysis

Multi-dimensional modeling capabilities

Territory planning

Scenario planning and what-if analysis

Drill-down capabilities and audit trail

Planful is an established corporate performance management platform that offers comprehensive revenue planning capabilities, though at a higher price point than most mid-market solutions. It offers a suite of predefined templates, financial consolidation tools, and reporting workflows, features that help standardize revenue planning across teams.

That said, it’s not a plug-and-play experience. Implementation is typically handled by third-party consultants and can take 3-6 months or more. It also supports only eight reporting dimensions, which may be a constraint for teams that need detailed segmentations or custom dimensions in their revenue plans. Integrations are limited natively and often require middleware to connect to core systems. Users consistently report a steeper learning curve and non-intuitiveness of the platform, which can slow adoption among non-financial team members involved in the revenue planning process.

Easily export model information from Planful to Excel

Intuitive UI that enables both regular and infrequent users

Good customer service for solving basic issues

Slow data retrieval and manipulation

Difficult to set up report templates

User setup is confusing, with complex configurations resulting in longer time-to-value

Steep learning curve

Structured revenue forecast templates

Audit trails and approval workflows

Consolidation and variance analysis

Mosaic provides some planning and modeling capabilities. However, it is more of a financial-BI tool than a comprehensive FP&A solution, with a number of integrations that help to consolidate and transform insights into accessible visuals. Mosaic was acquired by Hibob, a platform that serves the HR needs of mid-market businesses in early 2025. We have included it in this guide to help current Mosaic customers evaluate suitable alternatives by comparing what they have in Mosaic now with the other options discussed here.

Provides out-of-the-box templates to get started quickly

Robust scenarios modeling and what-if analysis

Offers real-time data updates (may be hampered by sync issues)

Model creation is rigid, highly inflexible and highly templated

Limited number of integrations

Unintuitive and complex to use with multiple tabs, selections, and input fields to navigate

Limited access controls to support secure collaboration

Basic collaboration tools compared to competitors

Longer implementation times due to significant configuration requirements

Advanced features needed for custom development

Multiple scenarios with simple what-if scenario planning

Limited but functional predictive forecasting capabilities

Automated variance analysis and tracking

Custom metrics

Cross-functional insights

Datarails takes an Excel-centric approach to financial planning, making it familiar for finance teams heavily invested in spreadsheet workflows.

The platform offers approximately 70+ integrations with common business systems, providing adequate connectivity for consolidating revenue data from various sources. However, its multi-currency support is basic, potentially limiting its usefulness for organizations with complex international revenue streams.

Where Datarails falls short is in multi-scenario modeling for revenue planning. Collaboration features include basic file version tracking but offer limited granular access controls, which can create challenges when working with sensitive revenue data across departments.

Excel-native interface familiar to finance teams

Automated variance analysis

Robust template library

Lacks functionality needed for advanced modeling

Even simple models require 100s of formulas

Works only with Excel, not Google Sheets

Few customization options

Limited visualization capabilities, particularly for complex analyses

Basic predictive capabilities (requires additional configuration)

Scenario planning (though limited)

What-if analysis (requires manual updates)

Cube sits in an odd middle ground; it's not as advanced as full-fledged planning platforms but offers more structure than just Excel. The implementation timeline of 3-5 months feels disproportionate to what it delivers, especially considering the platform's limited integration capabilities. With fewer than 50 native connectors, users are likely to encounter frustrating gaps when attempting to consolidate revenue data from various systems.

The platform's spreadsheet-native approach works well for teams that don’t want to leave Excel or Google Sheets behind, but this comes with inherent limitations for sophisticated revenue planning. The multi-currency support is surprisingly solid, making Cube a reasonable choice for companies with international revenue streams who don't need advanced modeling capabilities.

Using Cube effectively also requires more work than most of its competitors due to a combination of a limited dimensional structure. This, often requires complex ETLs to restructure data to fit into Cube’s system. Users have also reported performance issues with the system taking more than an hour to refresh larger data sets.

Seamless integrations with spreadsheets (Google Sheets)

Automates menial tasks

Multi-currency support

Expensive compared to rivals

Lack of flexibility in Excel reporting

ERP integration is not included in the base plan

Multidimensional analysis capabilities limited to 8 top-line dimensions

Drill-down capabilities are limited to the summary level

Automated data consolidation

Multi-scenario analysis

Customizable dashboards

The best revenue planning software for small businesses

For small businesses navigating today's volatile market conditions, effective revenue planning software has become an absolute essential. These solutions help small businesses forecast cash flow, model financial scenarios, and make data-driven decisions that align with both short and long-term objectives.

The right revenue planning platform empowers small businesses to move beyond basic spreadsheets toward advanced forecasting that previously was only accessible to enterprise-level organizations. When evaluating revenue planning software, small businesses should prioritize solutions that offer strong forecasting capabilities with shorter implementation timelines.

The most effective tools in this category combine robust financial modeling (including 3-statement modeling) with scenario planning functionality that allows teams to visualize different business outcomes based on changing market conditions. Additionally, platforms that offer role-based access and collaboration features ensure finance teams can work seamlessly with sales, operations, and executive leadership while maintaining appropriate security compliance.

We evaluated several small business revenue planning solutions and found three that are well-suited to meet their needs and those of SaaS startups. They are Fathom, Causal, and Excel.

In addition to their revenue planning capabilities, we’ve also evaluated the relative scalability of each software, which may be of particular interest to fast-growing SaaS companies looking for a solution they can grow with.

Check out the table below for a quick summary of how each of the three solutions we evaluated compares, then you can start digging into the details.

| Software/ Platform |  | .svg.png) | |

|---|---|---|---|

| Price | $$ | $$ | $ |

| G2 ratings | 4.6 | 4.5 | 4.7 |

| Out of box integrations | 15 | 12 | N/A |

| 3-statement modeling | |||

| Scenario planning | |||

| Revenue forecasting | |||

| Collaboration with role-based-access | |||

| Ease of use |

Fathom

Fathom is a financial analysis and reporting tool built for small business finance teams. It integrates with popular accounting platforms like QuickBooks, Xero, and MYOB. Its core strengths lie in visual reporting, KPI dashboards, and management reporting, making it particularly useful for SMBs that want to monitor financial health alongside high-level revenue trends.

While Fathom supports revenue forecasting, it is less suited for detailed revenue planning. Forecasts are generally based on historical growth rates or high-level assumptions and lack the granularity that SaaS or sales-led businesses might require. Scenario planning is available but limited to basic levers and simplified models.

Fathom is best for small businesses that prioritize clear, visual reporting over complex modeling. It helps users keep a pulse on revenue and profitability, but may need to be supplemented with spreadsheets or additional tools for planning beyond the near term.

Easy integration with accounting tools

Strong visual dashboards for revenue KPIs

Simple forecast setup

Accessible for non-finance users

Automated management reporting

Limited granularity in revenue modeling

No CRM integrations or pipeline-based forecasting

Scenario planning lacks flexibility

No support for deferred or recurring revenue logic

Not ideal for SaaS or high-growth businesses

High-level revenue forecasting from accounting data

Simple scenario planning (e.g. best/worst case)

Budget vs. actuals comparisons

Monthly and quarterly reporting templates

Causal

Causal is a lightweight modeling and forecasting tool designed to help small teams move beyond spreadsheets without committing to an enterprise FP&A system. It offers a clean interface for building interconnected financial models using natural language and modular logic. Revenue plans can be built by linking inputs across headcount, pipeline assumptions, and pricing, giving it more flexibility than traditional spreadsheet setups.

Causal was acquired by Lucanet in October 2024. Lucanet is a financial performance management software that serves primarily mid-market companies. While one of Causal’s co-founders, Lukas Kobis, has said that Causal will be shifting its focus to mid-market businesses in the future, for now, it still appears to be available to small businesses looking for an affordable, straightforward solution for their revenue planning needs.

Intuitive modeling interface

No-code logic and assumptions

Easy to share dashboards and scenarios

More structured than spreadsheets

Lacks built-in support for SaaS revenue mechanics

No native revenue recognition workflows

Limited integration depth (mostly manual uploads or APIs)

Some learning curve for new users

Driver-based revenue models

Scenario comparisons with adjustable inputs

Timeline-based revenue projections

Charts and dashboards for stakeholder sharing

Collaboration features for commenting and input

Microsoft Excel

Microsoft Excel remains the default planning tool for most small businesses. It’s widely accessible, highly customizable, and requires no additional investment, making it a natural starting point for revenue planning. From simple top-down forecasts to detailed bottom-up pipeline models, Excel can support a wide range of approaches as long as the finance team has the time and skill to maintain them.

Its biggest strength is flexibility. Excel allows teams to tailor models to the exact structure of their business. But this flexibility also comes at a cost. Version control, collaboration, and error management are constant challenges. As the number of inputs and assumptions grows, maintaining model integrity becomes difficult without strict discipline or added tools.

Growing businesses often find themselves building increasingly complex models that become difficult to maintain and prone to errors. The time spent managing and validating Excel models often increases exponentially with business complexity, creating a clear inflection point where more sophisticated tools become a necessity.

Universally known and highly flexible

Fully customizable revenue models

Can handle complex formulas and logic

No built-in version control or audit trail

High risk of formula errors

Collaboration is limited and error-prone

Not scalable for multi-team planning

Manual data updates required

Scenario modeling via manual duplication

Detailed assumption inputs

Template-based modeling capabilities

The 3 Best AI-Enabled Software for Revenue Planning

Artificial intelligence (AI) is transforming revenue planning by improving how finance teams forecast revenue, analyze pipeline trends, and build flexible, data-driven models. Today’s leading platforms are embedding AI to make planning faster, more accurate, and far less reliant on manual processes.

The tools reviewed below use machine learning (ML) and natural language processing (NLP) to modernize revenue workflows, making it easier to build models, monitor performance, and adapt to shifting business conditions. Whether it’s creating baselines from CRM data or proactively flagging anomalies in pipeline conversions, AI is helping revenue planning evolve into a more predictive and responsive process.

Each of these platforms takes a unique approach to embedding AI into revenue planning. Let’s look at how they compare.

Drive AI by Drivetrain

Drive AI powers Drivetrain’s revenue planning engine with a suite of tools that simplify the planning lifecycle, from baseline model creation to real-time monitoring and adjustment. It’s designed for finance and RevOps teams managing complex revenue streams across multiple go-to-market motions or business units.

AI Transforms helps turn raw CRM and billing data into structured inputs for revenue models instantly. This saves hours of manual data prep and ensures inputs like pipeline stages, ACV assumptions, and churn rates are up to date and consistent.

Model Generation builds initial revenue forecasts based on historical performance, headcount plans, or bookings, providing a fast starting point for planning cycles.

The AI Analyst gives teams the ability to ask natural language questions like “What’s driving the drop in Q3 new revenue?” or “How did pipeline coverage affect forecast accuracy?” This makes it easier to diagnose misses or validate assumptions without digging through spreadsheets.

Meanwhile, AI Alerts proactively flag anomalies like a sudden drop in conversion rates or a revenue forecast exceeding capacity assumptions so teams can course-correct early.

AI features that improve revenue planning:

- One-click generation of revenue forecasts from ERP, CRM, and billing data

- AI-powered data transformation to structure planning inputs

- Automated alerts for pipeline anomalies or forecast risks

- Natural language analysis of forecast vs. actuals

Anaplan Intelligence

Anaplan Intelligence brings AI to its revenue planning suite through tools that support collaborative forecasting, optimization, and predictive modeling. These capabilities are designed for finance teams that need to build granular, cross-functional revenue plans with embedded business constraints.

PlanIQ and Predictive Insights use historical sales and pipeline data to improve forecast accuracy. These tools go beyond linear growth trends by analyzing cyclical patterns, sales behavior, and seasonality to refine revenue projections.

Optimizer enables teams to set constraints like rep capacity, lead coverage, or pricing tiers, and determine the most efficient revenue allocations across territories or channels.

CoPlanner simplifies review cycles by enabling users to ask questions like, “What’s the optimal pricing scenario given Q4 targets?” or “Where are we underperforming against our sales plan?” It turns the review process into an interactive, data-driven conversation.

AI features that improve revenue planning:

- Predictive revenue forecasting based on historical data and sales drivers

- Optimization tools to align sales plans with capacity constraints

- NLP-powered model collaboration for scenario reviews

- Automated variance analysis and forecasting insights

Pigment AI

Pigment AI brings intelligent automation to every stage of the revenue planning process. Its NLP engine makes it possible for teams to explore different revenue scenarios, test sensitivities, and refine assumptions without manual model manipulation.

Smart prompts guide analysts through tasks like “Analyze retention impact on FY26 forecasts” or “Compare expansion revenue across regions.” During forecast cycles, Pigment AI can also suggest optimal visualization formats like waterfall charts for new vs. renewal revenue or tornado diagrams for sensitivity analysis, helping finance teams present their plans clearly and persuasively.

ML algorithms surface trends and outliers in historical performance data, allowing revenue teams to proactively refine growth assumptions, pricing models, and channel contributions.

AI features that improve revenue planning:

- AI-assisted scenario analysis and sensitivity testing

- Smart visualizations for revenue plan storytelling

- Natural-language prompts to refine forecasts

- Machine learning to surface growth trends and forecast risks

Drivetrain vs. the field: Why Drivetrain is the best revenue planning solution

Now that we have discussed the nitty-gritty of these platforms, narrowing down the options should be easier. Whichever tool you choose, ensuring it fits seamlessly with your existing workflows and enhances the team’s ability to provide strategic, data-driven advice is crucial.

Revenue planning is a very collaborative process requiring finance, RevOps, and GTM leaders to work together. Hence, the platform you chose should enable collaboration and should be easy enough for both finance and non-finance users to use.

Your decision could be the difference between a team that merely reports numbers and a strategic partner driving your organization’s growth and profitability.

With a 4.8 out of 5 rating on G2, Drivetrain emerges as a front-runner in both short-term and long-range financial planning and revenue forecasting capabilities. Its highly sophisticated and scalable calculation engine, spreadsheet-inspired UI, and multiple forecasting templates make it a go-to choice for both mid-sized businesses and enterprises.

With Drivetrain, you get complete visibility into historical performance, pipeline revenue projections, and future quarter projections with extreme accuracy.

Answer all the revenue-critical questions and pull the right levers with this powerful yet simple revenue planning solution.

How to choose the right revenue software for your business

What is revenue planning software?

A revenue planning software helps you estimate the income a business will likely generate in different areas over time. The software empowers FP&A and revenue operations (RevOps) teams to predict future revenue. Typically, a revenue platform analyzes past business performance, current trends, and other relevant factors to produce accurate revenue projections.

What features to look for in revenue planning software?

Here are some features to look for in a revenue planning software, no matter what the size of your business is or the industry you’re in:

1. Native Integrations

Revenue software generates forecasts by taking into account all relevant factors, including historical data and the latest trends. The more information your platform has, the more accurate and reliable the forecasts. Integrating your chosen revenue platform with CRM, ERP, and accounting software enables seamless data flow between systems. This ensures that forecast models have access to up-to-date information on sales pipelines, customer accounts, billing history, and financial transactions, ultimately leading to accurate forecasts, increased efficiency, and better insights.

2. Multi-dimensional revenue modeling and forecasting

The ideal revenue platform should allow you to model and plan the targets by adjusting assumptions and variables to perform scenario analysis and sensitivity testing. It should also provide customization options and configurable parameters so the forecasting models are trained based on your specific business requirements. This ensures that forecasts accurately reflect the nuances of your business.

Also, if you want your business to scale, you need to adopt everything that aids your objective, including your revenue software. As your company grows and evolves, your platform must be robust enough to scale in tandem with the rising complexity and volume of financial transactions. It should be able to handle large datasets without crashing or slowing down.

3. Automated reporting and dynamic dashboards

Interactive or dynamic financial dashboards enable finance pros to answer critical higher-order questions on-demand with up-to-date data. A revenue reporting dashboard, for example, should allow you to drill down to the transactional level and by any available dimension in your dataset across all data sources. This feature is a must when it comes to revenue forecasts as it’s essential to understand what’s driving growth or why there’s a gap between the target and actuals.

4. Collaboration and fine-grained access controls

Revenue planning is a cross-functional effort that involves finance, sales, marketing, and operations. Your software should make it easy for multiple stakeholders to collaborate without compromising data integrity. Look for platforms that support role-based access controls, so users can view or edit only the data relevant to them. Fine-grained permissions also help enforce accountability, prevent accidental changes, and ensure sensitive information stays secure. Collaborative features like comments, version history, and approval workflows can streamline the planning process and reduce back-and-forth.

5. Onboarding, training, and customer success

Handling financial and operational data isn’t easy and can prove intimidating for non-finance users. A great onboarding experience, a self-service oriented and intuitive interface where users can manage their datasets, metrics, models and user access, reduces friction. These features also ensure quicker resolution to queries.

Spreadsheets vs. revenue software: What to use?

The most effective revenue planning is collaborative, data-driven, and agile. However, many organizations rely on spreadsheets to deliver multi-million dollar revenue forecasts because most finance and sales professionals have a long history of working with them.

Excel and Google Sheets are simply not designed to overcome the issues organizations face when charting future growth. Information can quickly become siloed, and teams can become isolated in their thinking. Everything, including data and formulas, must be entered into a spreadsheet manually, so the more complex they become, the more accuracy issues start creeping in. While spreadsheets have improved over the years, they’re still not ideal for large-scale financial planning and analysis.

Do you often find yourself struggling with managing spreadsheets, and the thought of running yet another quarterly forecast in Excel makes you wish there was a better solution? It may be time to consider using revenue forecasting software.

FAQ

Our review of the many revenue planning tools revealed that what is the “best” software really depends on the size of your business. In this context, business size can be considered something of a proxy for the level of complexity in your business, which in turn, drives the types of features and capabilities you’re likely to need for revenue planning. Here are top contenders we identified as offering the most robust solutions for each category we reviewed:

Enterprise with 1000+ employees and/or more than $100M ARR

- Drivetrain

- Anaplan

- SAP Analytics Cloud

- Workday Adaptive Planning

- Pigment

Mid-market businesses with 50-1000 employees and/or $5-$100M ARR

- Drivetrain

- Planful

- Mosaic

- Datarails

- Cube

Small businesses & startups with 0-50 employees and greater than $5M ARR

- Causal

- Fathom

- Excel

Spreadsheets are familiar and flexible, which is why many teams still use them for revenue forecasting. But as planning becomes more collaborative, data-driven, and fast-moving, spreadsheets start to fall short. They’re prone to manual errors, siloed data, and version control nightmares, making them risky for high-stakes, multi-million dollar forecasts.

Revenue planning software solves these pain points with real-time data sync, built-in collaboration, multi-dimensional analysis, and the ability to run multiple scenarios instantly. If you’re spending more time managing spreadsheets than making strategic decisions, it might be time to upgrade.

AI is transforming how finance teams approach revenue planning, making it faster, more accurate, and significantly less manual. Drivetrain’s Drive AI is designed to put these capabilities directly into the hands of FP&A teams, enabling smarter decisions across every stage of the revenue planning cycle.

Here’s how Drive AI enhances revenue planning:

- AI Model Generation: Automatically build baseline revenue models from ERP, CRM, and HRIS data with a single click.

- AI Transforms: Need to adjust your revenue plan to account for seasonality, new pricing tiers, or churn assumptions? Just describe it in plain English. Drive AI instantly applies those logic updates across your dataset, helping finance teams iterate faster without touching formulas.

- AI Alerts: Stay ahead of revenue risks with real-time alerts. If pipeline conversion drops below the threshold, churn spikes, or a key metric diverges from plan, Drive AI notifies the right stakeholders.

- AI Analyst: Need a quick answer on MRR growth trends, forecast accuracy, or pipeline coverage? Ask the AI Analyst.

As AI adoption in FP&A accelerates, Drivetrain continues to expand what’s possible for finance teams. With Drive AI, revenue planning becomes more dynamic, more responsive, and ultimately, more strategic.

.svg)