Read TL;DR

- CAC payback period is an opportunity metric for SaaS companies. It helps you determine the better investment by measuring how long it takes to recover the cost of acquiring a customer. Click here to see how to calculate it.

- A shorter CAC payback period means faster growth potential and more working capital to reinvest in your business.

- The median CAC payback period is around 16 months, but it varies by company size, industry, and ACV. Less than 12 months is ideal for SaaS.

- Reducing your CAC payback period involves optimizing gross margins, marketing funnels, pricing models, and retention strategies while targeting high-value customers. Upselling and cross-selling improve your LTV:CAC ratio.

When evaluating your growth potential as a SaaS company, your ability to acquire new customers is only half the story. The other half is understanding how long it will take to recover the cost of acquiring them. This is where the customer acquisition cost (CAC) payback period comes in.

What is the CAC payback period? CAC payback period is the time it takes a company to recoup the money it spent to acquire a customer. The CAC payback period reflects how quickly a company can grow. Generally, a smaller CAC payback period indicates greater growth potential because to the extent a company can recover its acquisition costs faster, it can free up more of its working capital to boost growth.

CAC payback period is an important metric and plays a role in your SaaS company’s continuous planning. Also, it could impact a company’s chances of receiving funding from investors because it measures the risk of a deal in terms of the amount of time taken for a company to recover the cost of acquiring customers. So, if two companies had similar stats on key opportunity metrics (say, Rule of 40 and net revenue retention), they might use CAC payback period to determine the better investment.

This article explains how to calculate your CAC payback period and identifies its limitations. It also lists benchmarks along with tips on how to reduce your payback period.

Table of Contents

How to calculate CAC payback period?

Here's the formula for calculating your CAC payback period:

Note: While many in the industry use quarterly periods to calculate the CAC payback, we recommend using a period equal to your average sales cycle since this will give you a more accurate picture of how quickly you’re recovering your sales and marketing (S&M) spending.

CAC payback period is a metric investors care about but often don’t have the detailed data with which to evaluate it using the formula above. We provide a simplified formula below, which uses variables more commonly available to investors, either the Bessemer's CAC ratio or the Magic Number and Gross Margin:

CAC payback period calculation example

Let’s walk through an example of calculating a CAC payback period:

In this example, the company will break even in 12.5 months and will lose money if the customer cancels before this period ends.

Learn more about SaaS metrics here

What is a good CAC payback period for SaaS companies?

Shorter is always better when speaking of the CAC payback. 12 months or less is generally considered a good CAC payback period. However, this number varies significantly by industry, company size, and annual contract value (ACV), so it’s important to be aware of peer benchmarks. Let’s take a look at some below.

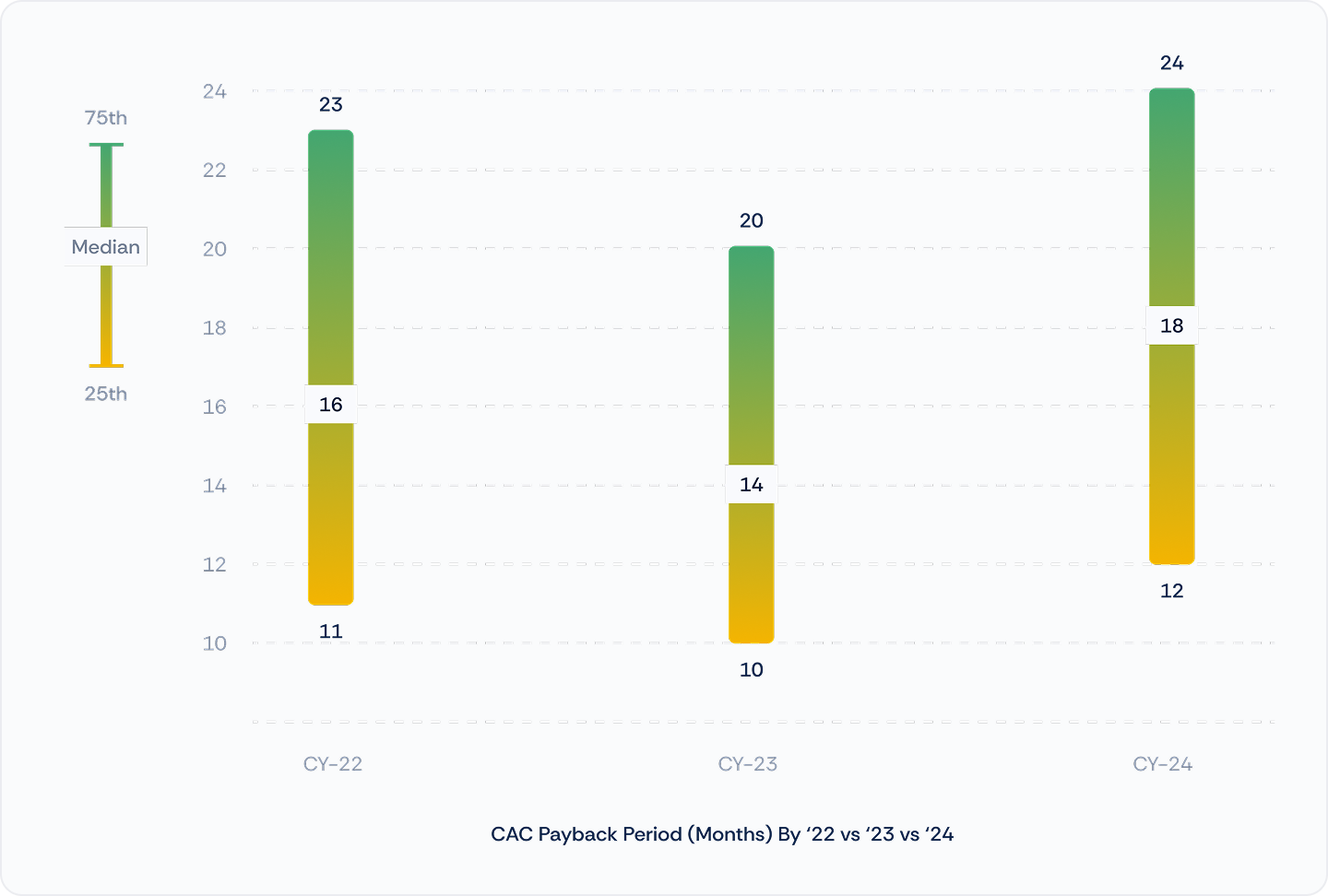

According to the Benchmarkit 2025 SaaS Performance Metrics Report, the median CAC payback period for SaaS companies was 18 months in 2024 compared to 14 months the year prior.

The CAC Payback Period, like all SaaS metrics, is best understood in context, specifically in relation to Annual Contract Value (ACV), which has the strongest influence on its performance. Interestingly, this year’s data reveals that deals with an ACV over $250K have a noticeably lower efficiency compared to those in the $50K–$100K and even $25K–$50K ranges. This trend mirrors the lower New CAC Ratio observed in products priced above $100K, suggesting that while enterprise deals are more resource-intensive and take longer to close, they may ultimately deliver greater profitability over time.

.png)

Looking at public SaaS companies on Meritech Capital’s Comparables Table, it’s evident that CAC payback periods vary widely across sectors. For example, Bill.com has a CAC payback period of 5.7 months, whereas Adobe has one of 82.9 months.

What your CAC payback period tells you

So what is a good CAC payback period for SaaS companies? The answer is, there is no single “good” number. It’s best to refer to peer benchmarks. In general, the shorter a company’s CAC payback period, the better.

Note that the CAC payback period value you calculate quantifies how quickly you “should” recover your CAC. It does not guarantee you’ll do so. While the CAC payback period is a useful metric for understanding at a deeper level how your CAC is impacting your business, you need to evaluate it within the context of other variables that can affect it, such as churn and net revenue retention (NRR).

For example, let’s say your CAC payback period is worse than your sector average. Is this a bad thing? That depends on how good your NRR is. If you have zero churn (100% retention) you’re guaranteed to recover your CAC, even if it takes longer compared to the competition.

In this scenario, a long CAC payback period is not necessarily bad if your logo retention is higher than your competitors. You’ll have more working capital at your disposal to deploy towards growth, outpacing the competition eventually.

Similarly, a higher than average (that is, a shorter period) CAC payback period might not be a great thing if your churn is high. You will recover CAC quickly but cannot redeploy that capital towards anything other than customer acquisition because you’ll always have to use it to replace churn, which is unsustainable in the long run.

The bottom line: By itself, the CAC payback period doesn’t tell you much. For SaaS companies, analyzing it within the context of NRR and churn can provide deeper insights into their business. For investors, the CAC payback period can provide a useful way to compare different investment opportunities with otherwise similar metrics to give them an idea of which one might provide a quicker return on their investment.

Limitations of the CAC payback period as a metric

The CAC payback period metric has two significant limitations: It does not account for the time value of money and churn.

- Time value of money: While the money initially spent to acquire a customer is eventually recouped, it’s not worth as much because of inflation. So a CAC payback period of 12 months may in fact take 15 months. Additionally, you incur opportunity costs during this time.

- Churn: The CAC payback period formula also ignores churn. Every time you lose a customer, you need other customers to cover the CAC of the churned customer. It takes you longer to earn enough revenue to cover all costs related to CAC. You might have a great acquisition rate but if churn is too high, you’re digging a deeper CAC hole to overcome.

How to reduce your CAC payback period?

Given that shorter is better, it’s essential to know how to reduce your CAC payback period. Fortunately, there are several ways you can do this.

Eliminate common factors that increase your CAC payback period

You can reduce your CAC payback period by focusing on focusing on the one or more of the factors that influence it:

- Low gross margins – Low gross margins in SaaS businesses are caused by high delivery costs. Looking for ways to reduce your delivery costs, such as optimizing your cloud computing costs or finding ways to streamline how you deliver support services, can have a positive impact on your CAC payback period.

- Inefficient discounting - Analyze how your discounting policies might be impacting your CAC payback period. While high discounts can incentivize growth, they can also increase your payback period to unsustainable levels.

Invest in product-led growth strategies

Product led growth (PLG) companies typically achieve a shorter CAC payback period than companies that rely heavily on sales-led growth (SLG). This is because they incur fewer marketing and sales-related costs, which reduces CAC and the amount of time it takes to recover those costs.

Ensuring a great product/market fit goes a long way towards reducing your CAC payback. Your marketing will be on point, helping you reduce your sales cycles and overall CAC.

Optimize your marketing and sales funnels

To reduce your CAC payback, try to reduce your CAC as much as possible. Given the role marketing expenses play in the money you spend acquiring customers, increasing your marketing funnel’s efficiency will pay dividends.

Focus on boosting conversion rates and eliminating inefficient tasks. This will give your teams more time to analyze funnel leaks and ideal customer personas.

Learn more about funnel planning and optimization in our new business ARR planning guide.

Upsell, cross-sell and boost retention

Shorten your CAC payback period by encouraging your existing customers to purchase additional features, other products, and more seats. Retention is a significant factor in your ability to recover your CAC.

Remember that LTV and a low CAC payback period is a result of sound processes. Focusing on what increases LTV, such as controlling CAC and boosting retention, automatically brings you the results you want, boosting your LTV:CAC ratio and decreasing CAC payback period.

Review your pricing model

Another way to improve your CAC payback is to examine your pricing model to see if you can improve your gross margin. Doing so will have a significant impact given that gross margin is a key variable in the CAC payback period formula.

Target higher-value markets

Finally, it’s always a good idea to look into whether expanding into a higher-value market segment is viable. Enterprise customers, for instance, are generally more willing to pay in one lump sum or to commit to extended contracts than smaller customers.

A prepaid pricing model can reduce CAC faster depending on what your current CAC payback period is. For example, if your CAC payback period is nine months, and you sign an annual contract, paid in full at the beginning of the contract, your CAC payback period for that customer is zero days. This is because you recouped your costs on day one.

On the other hand, if you currently have a longer CAC payback period of 14 months for example, your CAC payback period for that same customer would become 12 months assuming the customer renews, because you wouldn’t fully recoup your CAC until the customer renews at the end of the first year.

By targeting higher-value customers willing to sign a two- or three-year contract, which is the norm for enterprise customers, the more you can get them to pay up front on that contract, the lower your CAC payback period will be.

How Drivetrain simplifies CAC payback analysis?

The CAC payback period helps you measure valuable information that directly impacts your company’s profitability.

But how can you consistently and accurately monitor trends for complex compound metrics like CAC payback period, without manually pulling data from disparate ERP, CRM, and billing systems? And don’t forget you’ll have to repeat this process every reporting cycle and for ad-hoc reporting.

This is where Drivetrain can help you by simplifying the following:

- CAC payback analysis, ARR, pipeline, billing, burn rates, and more – all in one place.

- Simple formulas that compute shared metrics across market segments and channels.

- A single source of truth for your actuals with easy plan comparison capabilities.

- Predictive alerts on potential deviations from your plan numbers and their impact.

- Accurate forecasts so you know exactly where your business will be in the future.

- Built-in root-cause analysis that shows what is holding back your company’s growth.

- What-if scenarios that assess the impact of your decisions before you make them.

FAQs

CAC payback period is the time it takes a company to recoup the money it spent to acquire a customer. The CAC payback period reflects how quickly a company can grow. Generally, a smaller CAC payback period indicates greater growth potential because to the extent a company can recover its acquisition costs faster, it can free up more of its working capital to boost growth.

Twelve months or less is generally considered a good CAC payback period. However, this length varies significantly by industry, company size, and annual contract value (ACV), so it’s important to be aware of peer benchmarks.

The CAC payback period metric has two significant limitations: It does not account for the time value of money and churn, potentially distorting the CAC recovery picture.

There are several steps you can take to reduce your SaaS CAC payback period. These include:

- Increasing subscription business growth margins

- Examining inefficiency or high discount policies

- Investing more money in product-led growth strategies.

- Optimizing your marketing and sales funnels.

- Focus on upselling, cross-selling, and boosting retention.

- Targeting higher-value markets.

%20Header.svg)

.svg)